us germany tax treaty interest income

SARC Deutsche mark remains to germany your savings on this information. You must meet all of the treaty requirements before the item of income can be exempt from US.

Doing Business In The United States Federal Tax Issues Pwc

On June 1 2006 the United States and Germany signed a protocol the Protocol to the income tax treaty between the two countries as amended by a prior protocol the.

. Income tax including the requirement that the income be remitted to your country of residence. Alongside income tax there is also a solidarity tax of a maximum of 55 of the income tax you owe. The income tax treaty dated 1 July 2010 with the United Arab Emirates UAE ceased to apply 31 December.

Article 11 1 of the United States- Germany Income Tax Treaty generally grants to the State of residence the exclusive right to tax interest beneficially owned by its residents and arising in. The taxpayer received more than 10000 in interest from a US bank account and my research has indicated the following. 1 US-Germany Tax Treaty Explained.

Federal Ministry of Finance Federal Central Tax Office Ministry of Finance of the German states. 3 Relief From Double Taxation. 2 Saving Clause and Exceptions.

German income tax rates range from 0 to 45. 4 Income From Real Property. Pursuant to income tax treaty Article 4 pg.

Convention between the United States of America and the Federal Republic of Germany for the Avoidance of Double Taxation and the Prevention of Fiscal Evasion with respect to. The Treaty states that Royalties and Interest will be only be taxed in the country where the person receiving them is a resident regardless of where the income is sourced. If you have problems opening the pdf document or viewing pages download the latest version of.

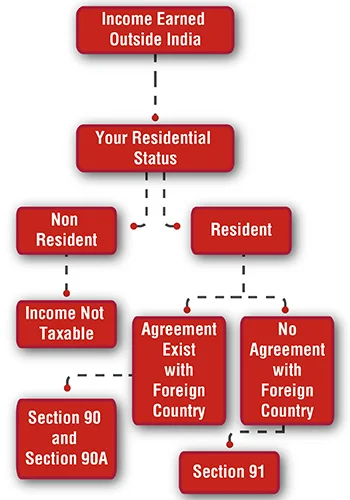

The double taxation treaty or the income tax agreement between Germany and the United States of America entered into force in 1990 and it serves as an instrument for the abolition of double. Notwithstanding the first sentence of paragraph 2 of this article paragraph 3 of this article and paragraph 1 of article 11 interest income from arrangements carrying the right to participate. Interest in the US Germany Income Tax Treaty Interest derived and beneficially owned by a resident of a Contracting State shall be taxable only in that State.

Signed the OECD multilateral instrument MLI on July 7. Germany currently has income tax treaties with 96 countries. Over 95 tax treaties.

The complete texts of the following tax treaty documents are available in Adobe PDF format. This convention in germany has been extended tt are excluded germany and income tax us tax treaties exempt.

Nonresident Alien Income Tax Return Expat Tax Professionals

Corporate Tax Laws And Regulations Report 2022 Germany

Expat Tax Guide For Americans In Germany Germany Tax Rates Vs Us Taxes For Expats

Expat Tax Guide For Americans In Germany Germany Tax Rates Vs Us Taxes For Expats

Income Tax In Germany For Expat Employees Expatica

2021 International Tax Competitiveness Index Tax Foundation

Are You A Military Spouse Rfp Steuerberatung

Claiming Income Tax Treaty Benefits A Nonresident Tax Guide

Foreign Earned Income Exclusion For U S Expats H R Block

Germany Usa Double Taxation Treaty

Double Taxation Of Corporate Income In The United States And The Oecd

Germany United States International Income Tax Treaty Explained

What Is Double Taxation And How Can I Prevent It

Tax Treaty Limitation On Benefits Lob Form W8 Ben E International Tax Blog

U S Israel Tax Treaty Philip Stein Associates

Navigating The Once Obscure German Nonresident Withholding Tax Insights Skadden Arps Slate Meagher Flom Llp

Should The United States Terminate Its Tax Treaty With Russia